Have you ever heard people talk about umbrella sales during rainy weather? Or have you ever travelled to a tourist hotspot in a foreign country and found that certain goods and services were ridiculously overpriced, such as when buying a SIM card upon arrival at a foreign airport?

Example of a SIM card vending machine at an airport

(Source: File:Simcard Vending Machine.JPG. (2012, September 29). File:Simcard Vending Machine.JPG. https://commons.wikimedia.org/wiki/File:Simcard_Vending_Machine.JPG)

All of these scenarios are related to retailers analyzing demand drivers and changing their business strategy in response to them in order to maximize sales.

What are Demand Drivers?

Factors that influence the demand for a particular good are often referred to as “Demand Drivers”, simply due to the fact that they drive demand for a good or service.

Just as human behavior tends to be influenced by a plethora of different factors, oftentimes there are a wide range of different factors that can increase or decrease the demand for a good or service. The relevance of demand drivers might vary across different products and even individual consumers, but there are a number of demand drivers that are often used in the retail industry. Examples of these include:

- Price

Price is the most commonly used example of a demand driver. If a price is too high, the demand for the product or service usually drops. On the flipside, if a shop lowers the price for a good or service, the demand usually increases.

In economics, the impact of price on demand is often described by the concept of price elasticity:

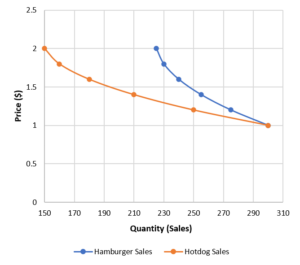

The above chart visualizes the concept of price elasticity for hamburger and hotdog sales.

We can observe that consumers have a stronger response to changes in hotdog prices as compared to changes in hamburger prices. As the price moves from $2/hotdog to $1/hotdog, the quantity in hotdog sales moves from 150 hotdogs to 300 hotdogs. In comparison, hamburger sales only increase from 225 to 300 assuming the same price changes. As the rate of change in hotdog sales in relation to price is larger than that of hamburger sales, hotdogs are said to have a “greater price elasticity”. A product is said to be “price inelastic” when the demand does not change with respect to price.

- Weather

Weather is an intuitive example of a demand driver. Say you have the choice of operating an ice cream store on a hot day versus on a rainy day and your sole goal is to make as much money as possible. Would you rather choose the hot day or the rainy day? Most likely, you will expect to have more customers interested in purchasing ice cream on a hot day than on a rainy day. Do note that for other products the relationship between weather and sales might be the direct opposite, such as when selling umbrellas or raincoats.

- Promotions & Discounts

For bargain hunters among us, it should come to no surprise that promotions and discounts can be effective tools to temporarily increase the demand for a good or service. This strategy is even more powerful when the promotion only lasts for a set amount of time, thereby creating a sense of scarcity and urgency. Repeated discounts can lose their novelty and effectiveness over time and as a result, discounts should be used with caution.

- Location

The location of a retail store can also have a significant impact on the number of sales that will occur. If a store is in a remote location, people might be less inclined to go out of their way to travel to the establishment to buy a product from here. On the other hand, if a store is located on your way to work, customers might be more inclined to make an impulse purchase when walking past.

- Queues (Abandonment vs. sign of quality)

Queue times can either increase or decrease the demand for a good or service. If the product or service is not deemed to be worth the wait, consumers will quickly abandon the queue and purchase. However, queues can also signal that a product is highly desirable. The picture below shows you how long people were willing to queue for the latest iPhone, because the product was deemed as worth the wait.

(Source:AsiaOne. (2019, September 19). AsiaOne iPhone Queue. AsiaOne IPhone Queue. https://www.asiaone.com/sites/default/files/styles/a1_og_image/public/original_images/Sep2019/190919_iphonequeue2_Facebook.jpg?itok=R8hP8O1Q)

- Special Circumstances and Events (e.g. COVID-19)

The ongoing COVID-19 pandemic is a clear example of how an external event or circumstance can influence the demand of a service or good. Shoppers afraid of the virus might be too scared to leave their houses and join other crowds of shoppers and as a result, thus leading to a reduction in consumer spending. Following the same logic, we might also observe an increase in online sales (incl. delivery), which shows that the same demand driver can have very varying impacts on the different channels of your retail business.

- Convenience

Many times the convenience of making a purchase can be a major contributor to whether or not a purchase happens. If the weather is rainy, it might be more convenient to place a food delivery order. If I do not want to speak to a retail assistant and can place my order through an electronic kiosk, I might be more inclined to make a purchase in a fast-food chain such as McDonalds.

(Source:Rensi, E. (2018, July 11). McDonald’s Says Goodbye Cashiers, Hello Kiosks. Forbes. https://www.forbes.com/sites/edrensi/2018/07/11/mcdonalds-says-goodbye-cashiers-hello-kiosks/#13eedc476f14)

- Sales Channels (E-Commerce, Agents, Retail)

Different sales channels might work better for different goods. When purchasing health insurance, many people prefer to go through an agent who acts as a trusted advisor. E-Commerce can often offer more choice and cheaper prices. Many people prefer to purchase clothing in retail environments as it allows them to feel the fabric and to try if the attire fits well. As you can see, demand drivers are not necessarily outside of your organization and might even be under your control to a certain extent.

- Footfall

Footfall is often looked at as the “king of demand drivers” in the retail industry because it is a factor that can predict future sales fairly accurately. If you have zero people entering your store, you will not be able to sell any goods, no matter how beautifully decorated your shop is. Another advantage of looking at footfall is how easy it is to track, monitor and analyze it.

- Competition (Substitutes vs. Complements)

Looking at the competition, such as nearby shops selling similar goods, can also give you meaningful insights. If a customer purchases an iPhone, the chances of that same customer buying an Android phone might be slim because most people are well off with just one smartphone.

Complements are products that would complement a purchase – for example, after buying an iPhone, the chance of you purchasing an iPhone case is most likely high.

- Consumer Income Levels (Inferior Goods vs. Normal Goods)

In economics, goods are often categorized into two categories: Inferior Goods and Normal Goods. Inferior goods are goods for which the demand drops as consumer income levels increase (e.g. instant noodles).

Normal goods are products or services for which the demand increases as income levels rise. Examples of that could be handbags, real estate, clothing, household appliances, etc.

Often a key difference between inferior goods and normal goods is a difference in the quality of the goods themselves. When income levels drop or the economy as a whole contracts, consumers might be more likely to turn to purchase inferior goods.

How to capitalize on demand drivers?

Now that we have taken a look at the most common demand drivers (the list is certainly not exhaustive and there are plenty of other factors that can drive the demand for a good in a retail setting), we need to ask ourselves how we can turn this knowledge into an advantage that we can capitalize on. In other words, how can we be prepared to make a sale when a demand driver is driving a sale our way? In the following sections, we will discuss three key steps to capitalize on demand drivers in a retail environment.

- Differentiate between relevant and irrelevant demand drivers and use them to forecast sales

Understanding which demand drivers influence sales can be a helpful tool to help you forecast future sales. While weather might have a large impact on ice cream sales, the location of the ice cream store might be even more important. No matter how hot or sunny the weather is, if your store is too far away, consumers won’t be willing to buy ice cream at your store. It is therefore important to understand which particular demand drivers influence your business and which have irrelevant or negligible impact on your business.

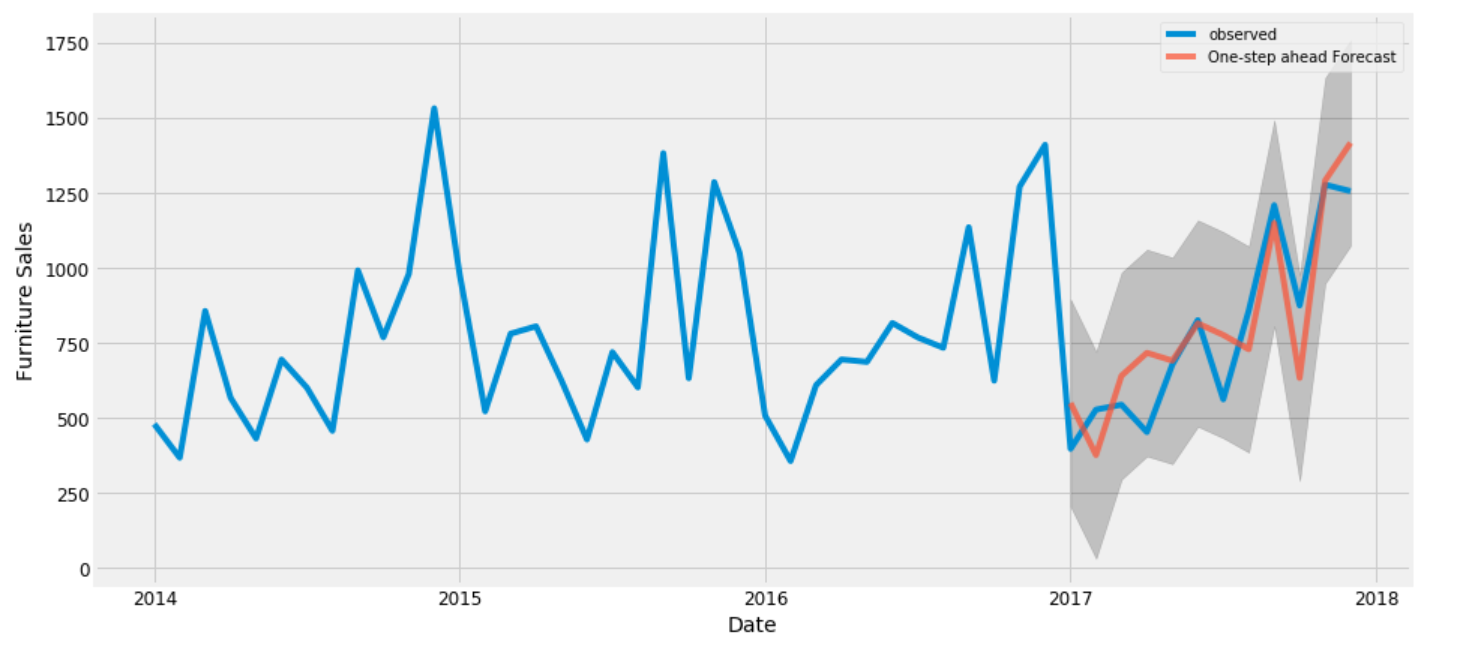

Forecasting might not always be as straightforward as a straight trendline

(Source:Bhaarath, V. (2020, May 5). Time Series Forecasting – Becoming Human: Artificial Intelligence Magazine. Medium. https://becominghuman.ai/time-series-forecasting-7ac3344a8588?gi=1aa0b60c2f5d)

Walmart’s expansion to Germany in 1997 is a good example of a failure to understand the relevant demand drivers for their business. One of the reasons why Walmart never managed to achieve scalable profitability in Germany was because it did not fully understand the “Pricing” demand driver in the local market. After slashing their prices with a technique called “penetration pricing” to rapidly gain market share in Germany, the German High Court ordered Walmart to raise their prices. This was done to prevent Walmart from gaining a monopoly in the local market and to encourage healthy competition with other local retailers. Because of this (and other reasons). Walmart decided to leave the German retail industry in 2006 after incurring a US$1B loss in their expansion to Germany.

(Source:Jackson, B. (2019, February 22). Single Post. Brittany Jackson. https://brittaniaten.wixsite.com/brittanyjackson/single-post/2017/12/19/Wal-marts-Expansion-Their-North-and-South-American-Success-and-German-Failure)

- Track demand drivers and monitor them in real-time

Knowing which demand drivers are relevant is only one piece of the puzzle. You also need to track the relevant demand driver data to be used for strategic decision making. With the right data available to you, it will be much easier to recognize consumer behavior, recognize patterns and trends. For instance, you might be interested in footfall by day of the week and recognize that consumers are more likely to make most of their purchases on weekends. In addition to tracking these data points over time (historical analysis), you might want to factor in real-time data such as footfall (captured by CCTV systems) or sales figures (captured by POS systems) to make adjustments to your forecast in real-time. The rise of footfall counting systems is a major change in the retail industry that has gone unnoticed by many of us.

- Adjust your operations to your unique drivers to best translate demand into sales

After recognizing which demand drivers influence your business the most and tracking them both in real-time and factoring in historical trends, the next logical step is to translate this intelligence into actionable business decisions which will generate additional revenue.

One area in which retailers can do this is by dynamically adjusting their staffing levels in response to the most relevant demand drivers of the business. Most retailers follow relatively fixed staffing levels for their workforce (e.g. cashiers, stockers, cleaners, etc.). While this approach is simple to understand, manage and follow, it often fails to factor in an appropriate response to the relevant demand drivers of this business. This can lead to a misalignment between the demand (i.e. sales) and supply (i.e. workforce). If demand exceeds the supply, this will often lead to long queue times, poor customer service and overtime required by the workforce. Conversely, if supply exceeds demand, the workforce will be idle and not generate any revenue, while the business still needs to remunerate them for their time.

In an ideal world, achieving a perfect balance between supply and demand would eliminate any inefficiencies and wastage (unnecessary cost or lost revenue). Fortunately, this ideal world is no longer just part of a distant future utopia thanks to the help of technology. Workforce Optimizer is an AI-enabled workforce management provider that can track and analyze the relevant demand drivers for a retail business and provide real-time feedback and make decisions related to the company’s staffing needs at a 15-minute interval. This is done by taking a combination of historical data points (e.g. sales figures for the last 2 years) and a real-time data source (e.g. sales figures reported by the POS system or number of footfall captured by a camera). If the amount of footfall suddenly drops, the Workforce Optimizer platform might choose to give retail workers an early break or shorter shift to better prepare them for future points in time when the demand might spike (e.g. during a lunch break). Using historical data, we at Workforce Optimizer have found that we can achieve a decrease in the misalignment between supply and demand from +/- 10% to +/-2%, leading to a reduction in cost per unit of service of 5%-15%.

Conclusion

In the real world, several hundreds of factors might impact the demand for your products and services. Luckily, most of the time a handful of these factors will allow you to make relatively accurate and meaningful predictions. Coupled with the right technology and tools, you can ensure that your business minimizes inefficiencies and waste such as staffing overcapacity and overtime hours while at the same time achieving revenue growth.

Interested to learn more? Contact us here for a free consultation with one of our workforce management consultants.

AUTHOR

Florian Parzhuber is a Workforce Management & AI Specialist at Workforce Optimizer, a leading AI-Enabled workforce management solution. Having lived and worked in China, South Korea as well as Europe, he accumulated extensive knowledge on the challenges large enterprises face across the globe. Florian married his interests in technology and social impact at Workforce Optimizer where he hopes to capitalise on the power of machine learning and resource optimization to drive positive social change. He can be reached at florian@workforceoptimizer.com.

Florian Parzhuber is a Workforce Management & AI Specialist at Workforce Optimizer, a leading AI-Enabled workforce management solution. Having lived and worked in China, South Korea as well as Europe, he accumulated extensive knowledge on the challenges large enterprises face across the globe. Florian married his interests in technology and social impact at Workforce Optimizer where he hopes to capitalise on the power of machine learning and resource optimization to drive positive social change. He can be reached at florian@workforceoptimizer.com.